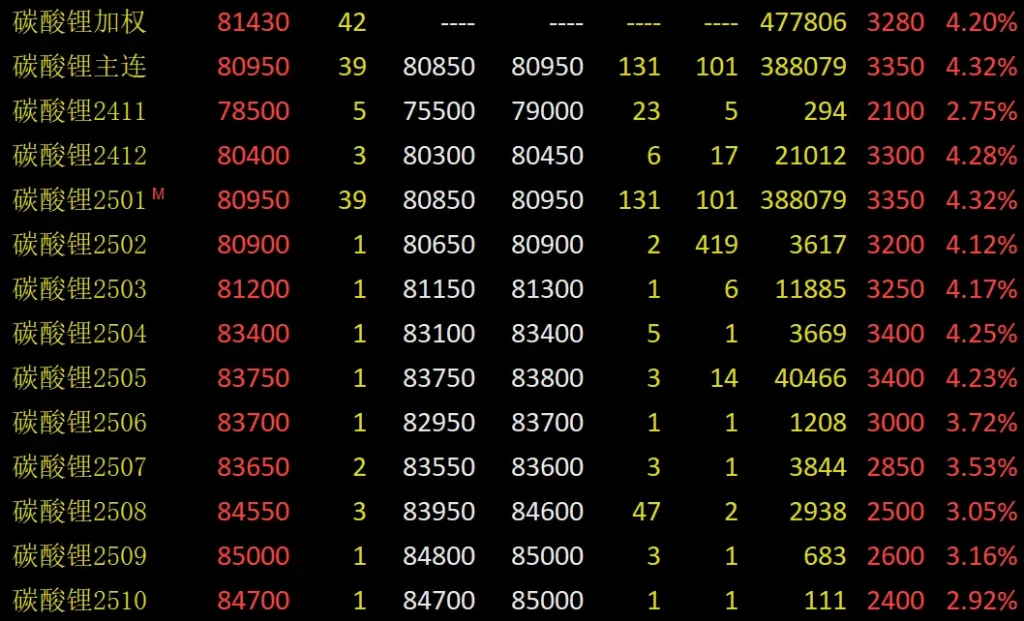

On November 11, lithium carbonate futures soared to 80,000 yuan/ton. As of the close of the day, the main LC2501 contract closed at 80,950 yuan/ton, up 4.32%. At the same time, trading volume and open interest rose sharply. The lithium carbonate index added 60,300 lots, a record high.

Yu Shuo, an analyst at Chuangyuan Futures, believes that lithium carbonate futures broke through 80,000 yuan/ton. Multiple favorable factors caused this. On one hand, the favorable macro policies boosted power battery use. It exceeded expectations. On the other hand, with the results of the US election, subsequent tariffs may increase. Domestic battery factories have boosted production to increase exports. The Spring Festival next year will come earlier, so companies have stocked up. Demand remains strong.

Liu Qiyue, an analyst at Xingye Futures, said that strong demand drove a big rise in lithium carbonate futures yesterday. From the view of production and procurement, performance exceeded market expectations. The turning point in battery cell production has not appeared. Also, lithium salt procurement has not declined on a large scale.

Development status of new energy vehicles in China

The China Automotive Power Battery Industry Innovation Alliance released data. In October, my country’s power battery installation was 59.2GWh. This is up 8.6% month-on-month and 51.0% year-on-year. Structurally, the proportion of lithium iron phosphate battery installations has further increased. Of the total installed capacity, ternary batteries had 12.2GWh, or 20.6%. This is down 7.2% month-on-month and 1.1% year-on-year. Lithium iron phosphate batteries had 47.0GWh, or 79.4%. This is up 13.7% month-on-month and 75.1% year-on-year. From January to October, my country’s power batteries had a capacity of 405.8 GWh. This was a 37.6% increase year-on-year.

Also, the old-for-new policy and year-end auto company push increased car sales in October. This drove battery installations to a record high for a month. Data from the China Association of Automobile Manufacturers shows that, in October, new energy vehicle production and sales reached 1.463 million and 1.43 million, respectively. This is up 48% and 49.6% year-on-year. New energy vehicle sales accounted for 46.8% of total new vehicle sales.

The current supply of lithium carbonate is, overall, relatively loose. A slight increase in supply has gradually eased. Data show that, in October 2024, lithium carbonate production was 59,000 tons. This was a 3.6% decrease from September. Domestic lithium carbonate production in November is estimated at 58,900 tons. This is a 0.1% decrease from October. However, in the short term, the output is basically stable. As of the week of November 8, the sample companies produced 13,500 tons of lithium carbonate. This was a 4.33% increase from the week before.

With the rise in marginal effect, lithium carbonate has destocked for 10 weeks. This also shows strong future demand. Data shows that, as of the week of November 8, the weekly inventory of lithium carbonate was 110,700 tons. It was a decrease of 3,345 tons from the previous month. Of the total, smelter inventory was 35,800 tons, down 4,701 tons from last month. It was the year’s lowest level.

Recent situation of lithium carbonate futures

Li Suheng, a researcher at CITIC Futures, has a view. He thinks yesterday’s rise in lithium carbonate prices, plus some factors, fueled bullish sentiment. These factors include a spike in demand in November. Also, overseas miners cut their future production guidance in Q3 reports. Recent reports from Australian mines show a market shift in the 2025 supply and demand outlook.

Some lithium mines have cut their production guidance, expanding production cuts. For example, Liontown plans to cut its ore production target by 2027 from 3 million to 2.8 million tons. It aims to produce 260,000 to 295,000 tons of SC6 spodumene concentrate. Pilbara plans to put the Ngungaju plant into maintenance mode on December 1, 2024. It will cut its fiscal 2025 lithium concentrate production guidance by 100,000 tons to 700,000 to 740,000 tons.

The third-quarter report on Australian mines says the current lithium carbonate price will make mines cautious next year. Also, Australia’s lithium supply is expected to rise slightly next year, which is below market expectations.”” Yu Shuo said.

Futures Daily’s reporter noted that, since late October, lithium futures have been rising. Does the rise in lithium carbonate futures, above 80,000 yuan/ton, signal a turning point?

Wei Chaoming, an analyst at Founder Futures, said lithium carbonate futures are up. This is due to improved macroeconomic conditions and better supply and demand. The rise in lithium battery stocks has, to some extent, boosted lithium carbonate prices. However, there are differing views on lithium futures prices. Demand for lithium carbonate is seasonal. Supply of lithium salts has high growth potential.

So, in the long run, some doubt that lithium prices have bottomed out. He believes the high lithium carbonate inventory will hurt the market. It is a key factor limiting its rise. Mysteel analyst Li Pan believes the circulation market is tight in November. The long-term contract discount for next year is not yet finalized. Most lithium salt plants have a strong willingness to support prices. With strong demand in November, lithium salt prices should rise short-term. Watch for changes in tourist levels and supply.

Li Suheng warned of high demand expectations for lithium carbonate. Though demand is strong now, there is a long-term oversupply. This may cause an “even slower off-season” after December. Lithium carbonate prices are expected to fluctuate widely for 1 to 2 weeks.