Lithium batteries, particularly lithium-ion batteries, are composed of several key materials that contribute to their performance, energy density, and safety.

What is the current production status of the lithium battery materials industry?

Since August, the lithium battery material industry’s production has improved. Data shows a 10% month-on-month increase in output. The leading companies have now reached full production. Some companies are not at 100% capacity. But, the industry’s operating rate is high. Some small and medium-sized enterprises may have an even higher rate. However, the actual capacity utilization rate may be higher than the reported 60%. It is expected to rise to about 63 to 65 in November.

Are there any structural changes in the current lithium battery materials industry?

Currently, the lithium battery material industry has not changed much. Leading companies should do well in December. Overall sales may be flat or rise month-on-month. Sales of high-end products, like high-voltage and high-density ones, should stay stable or even rise. But, sales of mid- and low-end second- and third-generation products may drop.

Has the pricing model in the lithium battery materials industry changed?

The lithium battery material industry’s pricing model hasn’t changed. It still multiplies the three-coefficient by a certain multiple. Then, it adds the price of iron phosphate and the packaging fee. However, the degree of order negotiation for each company is different. This year, both buyers and sellers are cautious about discounts in new orders. They no longer give large discounts as easily as before. At the same time, mainstream prices for processing fees are stable. In high-end products, costs are higher. Sellers try to increase profits. But, high-end products are already expensive. So, price hikes are limited. Also, key talks on next year’s price negotiations are expected at the end of this month or the beginning of next.

Do current material companies have the intention to raise prices and what is the expected increase?

Now, material companies want to raise prices. They are eager to improve their poor conditions, given the low market prices. It is understood that BYD can accept a stronger price increase. But, the extent of the increase needs to be determined through negotiations. The industry wants to avoid losing money.

What is the relationship between current capacity utilization and industry price increases?

Industry talks say that, at 60% capacity, firms stop cutting prices and seek profits. In the peak season of Q3 or Q4, capacity use should rise above 70%. Price hikes may be bigger then, to offset losses and avoid ST status.

Are other materials also experiencing price increases?

Due to a shortage, some materials, like lithium hexafluorophosphate, are rising in price. There were price increases in February, March, and June this year. Some small and medium-sized enterprises are more vulnerable to market fluctuations due to their size. They may be the first to sell out. This drives up prices across the entire industrial chain.

How is the price trend of iron phosphate?

After fluctuations from late last year to this year, the price of iron phosphate may stabilize for a time. However, there are also views that its price may continue to rise for a while. The trend needs further observation with market supply and demand.

What is the industry status of lithium iron phosphate batteries at current market prices?

Lithium iron phosphate now costs about 10,000 yuan. It’s up from last year’s low, but the price has barely changed. It has stayed around 10,100 to 11,000 yuan. Due to costs, losses are common in the industry. A few companies can only avoid losing money. The market shows the lithium iron phosphate battery industry is under pressure. But, some companies may keep operating by other means.

Why do you ask for a price increase in October and November?

The price increase request appeared in October and November. Demand was high then. A price increase attempt in June failed. Demand has been strong for three months. A price increase has been brewing since September. In November, we tried to warn customers to avoid price drops due to off-season bidding.

What are your views on the future incremental expansion and market demand for high compaction density products?

The expansion of high compaction density products will take time. The production method of the fourth-generation products is known. But, the specific parameters are still confidential. Currently, there are not many manufacturers that can produce the fourth-generation products. There will be some new supply in the future. But, it will take time to fully replace existing products and gain market acceptance. Also, high-end products are expensive and low-end ones are plentiful. So, there may be price hikes to fix corporate losses.

What is the current situation on the supply side and what is your judgment on the possibility of future price increases?

At present, the supply side is dominated by some old enterprises, and there are few new forces. On the cost side, as the processing fee increases, it may drive price changes. The market price is strong now. But, it may not rise much in December. Demand can’t stay high for long. The market situation is expected to be poor in the first half of the year. This round of price increases is more of a trial nature. The real price increase point may have to wait until the second half of the year or even the second half of next year.

What is the cost difference between the mainstream process and the iron phosphate process?

The mainstream process is the iron phosphate process. Over 80% use it. A small part uses small processes, like iron red. The antelope iron and iron nitrate processes are similar in cost to the iron phosphate process. But, the iron nitrate process is cheaper due to its stable quality and high demand. In contrast, ferrous oxalate is expensive. Its core raw materials have fluctuated in price, with ferrous iron rising by over 400 yuan. This has increased costs.

Can the iron phosphate process under different production capacity conditions achieve a production level similar to Fulin?

The iron phosphate process can be optimized to match Fulin’s output. But, some performance may not be fully achieved. For example, Funing’s 2021 products meet some performance standards. But, they are too expensive for most companies. Now, Ningde and Fengchao are the main makers of this high-end iron phosphate product.

Will the increase in loss rate affect production capacity and price increase logic?

In theory, a higher loss rate will reduce production capacity and may raise product prices. An increase in the loss rate during production will raise costs. This will push up product prices. Some high-voltage, high-density capacity may be affected by the production cuts after the 20th, judging from the industry’s average operating rate data. This may impact market prices.

Are the expectations for an increase in the proportion of fast charging next year optimistic?

The rise in fast charging next year raises hopes. Major customers expect it. At the same time, the structural price reduction of high-end products may also bring opportunities for bottom prices. High-end products have risen in price due to supply and demand. A high operating rate is now needed. The previous low prices caused losses and reluctance to produce. Now, the market has improved, but supply can’t be increased.

Will there be price elasticity on the demand and supply sides of fast charging next year?

For the demand and supply sides of fast charging, there may be price elasticity next year. As car models are updated, demand for fast charging will rise. Supply will depend on the production capacity of the materials. Once new capacity is released, it will affect the supply of fast charging products.

What is the reason why the fourth quarter data this year exceeded expectations?

The fourth quarter data exceeded expectations. This was mainly due to changes in subsidy policies. The national shift of subsidies from automakers to consumers, and local subsidies, made them more attractive to car buyers. Also, consumers were eager to buy subsidies before year-end. This high demand lasted until December, exceeding expectations. Also, the strong stock market boosted investor sentiment. Investors were more optimistic about future sales.

What is the current order situation and expectations for the next quarter?

The order situation is unclear. We lack full data for December. The specific correction range for the first quarter cannot be accurately determined. We can only make predictions based on the situation in previous years. It is expected that the month-on-month decline may be around 20 to 30 percent. The industry’s off-season due to the Spring Festival is also a factor.

Why do lower-priced products give different companies widely varying profit margins?

Lower-priced products’ profit margins vary by product category. For example, Company C’s products are mostly high-density or next-gen high-pressure ones. So, their overall price will be higher. If prices are raised, they will usually start with unprofitable products. This is to ensure that money-making orders are executed. Then, they will slowly adjust product prices as demand and profits change. High-end products are profitable. But, they may be adjusted before low-end products when prices rise. Demand for high-end products is stable. Also, price cuts help maintain market share.

What generation of BYD products are there and what are their prices? Which product categories are expected to increase in price first and what is the pace of the price increase?

BYD should be a second-generation product with a relatively low price. Some product categories of Company B will see price hikes first. Then, when capacity utilization hits 70% next year, all materials will rise in price. The price increase may be 3,000, rather than the 500 or 1,000 discussed before.

Is the general processing fee for CATL products above 15,000?

Yes, CATL’s general processing fee is more than 15,000.

Without subsidies, how reliable is the forecast of 20% growth next year?

Without subsidies, capacity utilization may not hit 70% next Q3. We doubt the 20% growth forecast. It assumes subsidy grabbing and a linear extrapolation. Actual guidance may need to refer to data from the off-season.

What is your opinion on next year’s subsidy policy?

It is expected that subsidy policies will still be introduced in the second half of next year. There may be no subsidies in the first half of the year. The situation may be similar to the second half of this year, with a rush to install during the peak season.

How do you view the current lithium price and its future trend?

Lithium prices are high now. The processing fee has stabilized. But, demand and supply will determine future prices. A gloomy outlook for lithium prices next year may cut supply. If the price rises above 80,000, supply will increase. The market may be oversupplied next year.

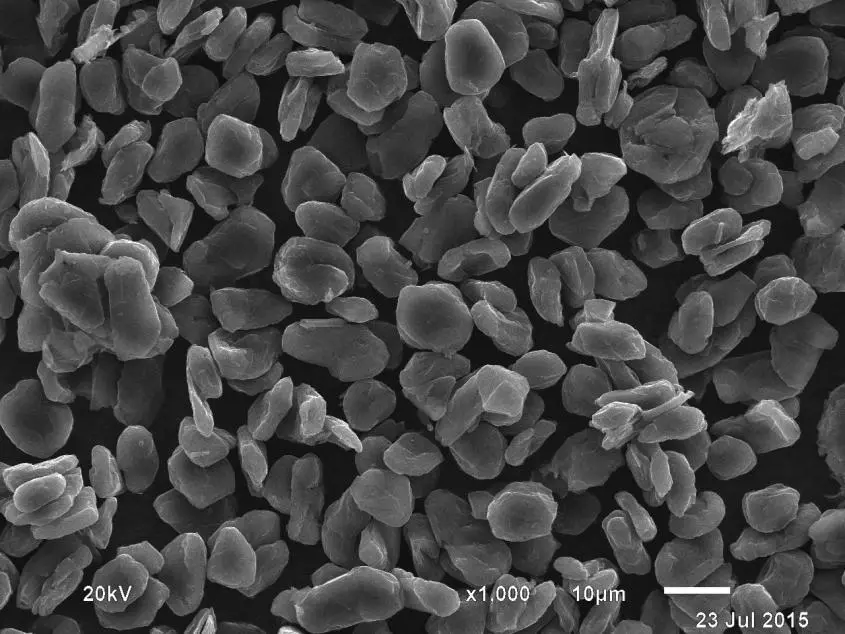

Lithium battery material related crushing equipment

Recycling or manufacturing lithium battery materials often needs special crushing equipment. It must handle the unique properties of lithium-ion cells, electrodes, and other components. Here are some types of crushing and related equipment used in the lithium battery industry: